inheritance tax on real estate nc

3 Is inheritance taxable in North Carolina. The inheritance tax of another state may come into play for those living in north carolina who.

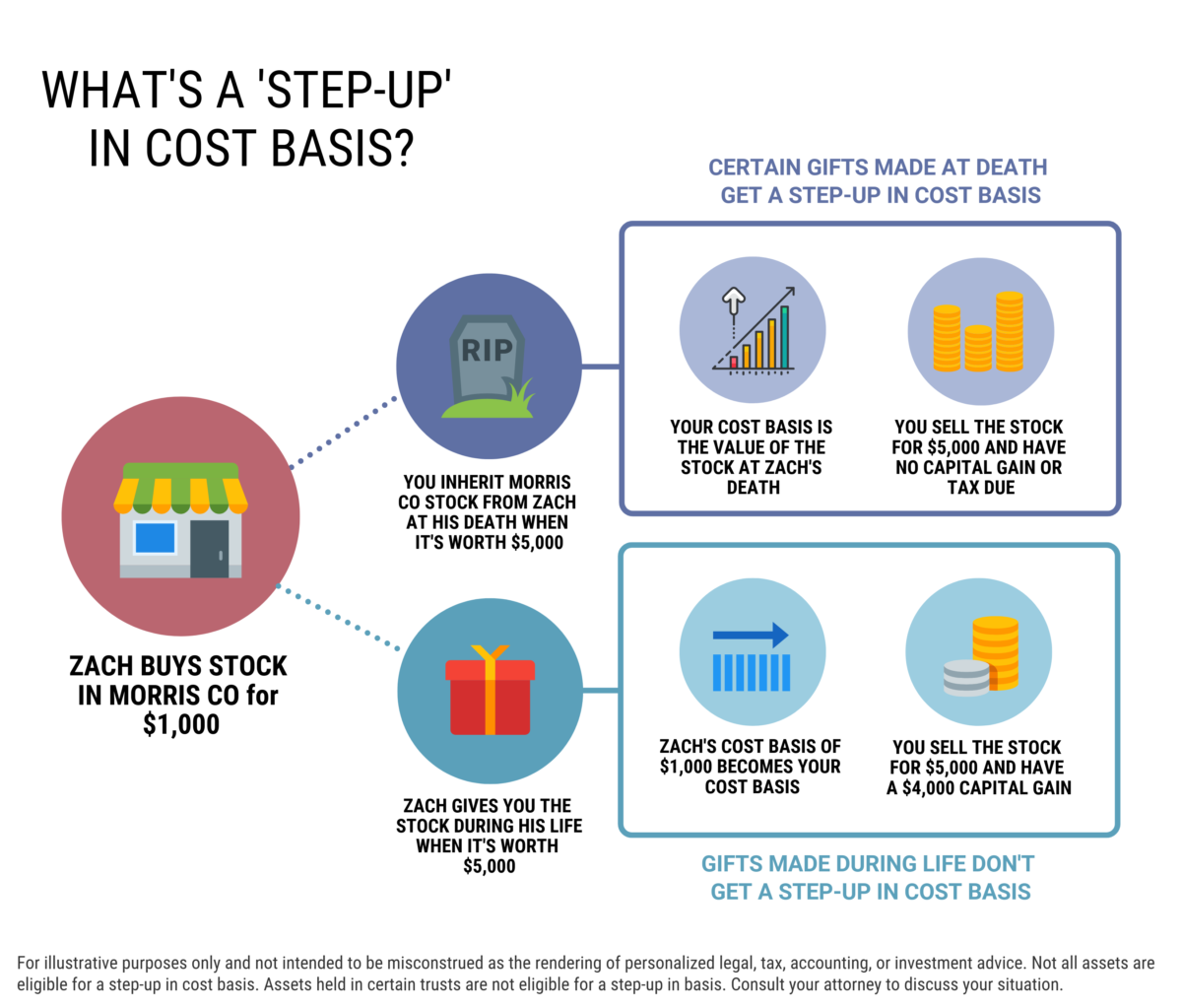

What Is A Step Up In Basis Cost Basis Of Inherited Assets

THE BASICS OF NC INHERITANCE LAW.

. Tax implications depend on the type of asset the value and other factors. If you die with two or more children or descendants of those children your spouse will inherit a third of intestate real estate and the first 100000 of. Put another way that means that you have a 998 chance of never having to worry about estate taxes.

Allocation of Income Attributable to Nonresidents. Unfortunately it can be a shock for some surviving family members. PO Box 25000 Raleigh NC 27640-0640.

In fact the IRS does not have an inheritance tax while some states do have one. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo.

North Carolina is one of 38 states with no estate tax. As the recipient of an inherited property youll benefit from a step-up tax basis meaning youll inherit the home at the fair market value on the date of inheritance and youll only be taxed on any gains between the time you inherit the home and when you sell it. So if you live in N.

While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. While north carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. Both inheritance and estate taxes are called death taxes.

These include Capital Gains income tax from retirement accounts and other like taxes. North Carolina has no inheritance tax or gift tax. The deceased persons estate must be managed and dispersed in accordance with their will.

Fortunately few states impose an inheritance tax. The courts oversee the dispersal of the assets and payment of debts to ensure the wishes of the decedent as outlined in their will is honored. 4 Does North Carolina have an estate tax or inheritance tax.

Carolina but inherit assets from an estate in another estate you could have to pay inheritance tax. If someone dies in north carolina with less than the exemption amount currently 11580000 their estate doesnt owe any federal estate tax and there is no north carolina estate tax. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer.

1 Do you have to pay taxes on inherited property that was sold. For example lets say the house you just inherited from your. These tax issues vary a great deal based on state law and unique circumstances so if you have a tax issue or other legal issue contact King Law at 888-748- 5464 KING for a consultation.

Creating a will allows the testator to leave their assets to a spouse heirs close relatives and other dependents. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. 6 Do beneficiaries have to pay taxes on inheritance.

Prior to 2013 the state did have an estate tax but it was repealed in July 2013. As in other states the legal process of dealing with a decedents estate in North Carolina is known as probate. The federal gift tax has an annual exemption of 16000 per recipient.

North carolina inheritance tax and gift tax there is no inheritance tax in north carolina. Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. No inheritance tax in nc.

A surviving spouse is the only person exempt from paying this tax. 2 Do I pay capital gains tax if I sell an inherited property. We have offices located across western North Carolina and upstate.

North Carolina Department of Revenue. North Carolina Estate Tax. In other words you can make up to 16000-worth gifts to as many people as you wish every year.

It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act. Are You Inheriting Real Property In NCCall 202 826-8179 or You may fill out the form below to get a quick fair cash offer on the property and a fast response. 7 Do seniors have to pay capital gains tax.

In more simplistic terms only 2 out of 1000 estates will owe. Tax Bulletins Directives Important Notices. 5 Does the IRS know when you inherit money.

Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015. Bank accounts certificates of deposit. There is no federal inheritance tax but there is a federal estate tax.

A married couple can gift away up to 32000 to. Maryland collects inheritance taxes on the value of property personal property real estate. The repeal retroactively applied to all deaths from January 2013 onward.

The top estate tax rate is 16 percent exemption threshold.

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

How To Sell A House You Inherited In Miami The Reality Behind Probate Estate Lawyer Probate Estate Law

Wholesale Opportunity In Reidsville Nc We Buy Houses Flipping Houses Home Buying

Sell Your House North Carolina Selling House Sell House Fast We Buy Houses

Explaining The Basis Of Inherited Real Estate What It Means For Your Kids

What Happens When You Inherit A House Home Sellers Guide

Taxes On Your Inheritance In California Albertson Davidson Llp

Inheriting A House With No Mortgage

How To Settle Sibling Disagreements And Make Better Decisions On Selling An Inherited Home Check This Out Inheritinghometips Sale House Home Selling House

How Do State Estate And Inheritance Taxes Work Tax Policy Center

5166 Follansbee Rd Winston Salem Nc 27127 Mls 000884 Zillow Us Real Estate Winston Salem Salem

207 N Locust St Black Mountain Nc 28711 Colorado Homes House Black Mountain

Capital Gains Tax On Inherited Property Bhhs Fox Roach

A Guide To Selling Inherited Property Smartasset

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Education Real Estate

Capital Gains On Inherited Property

Do You Pay Capital Gains Taxes On Property You Inherit

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A